Unintentional Fraud: Can It Impact Your Healthcare Practice?

The accusation of fraud in healthcare services implies that a person intentionally and willingly tried to gain a financial benefit by making false claims to receive money or compensation to which they are not legitimately entitled. Unintentional fraud, often referred to as abuse, is any unintentional practice that results in an overpayment to the healthcare provider.1

One of the most common types of fraud is trying to inflate claims to state, federal or private health insurance schemes. These claims may be entirely false, where no treatment was offered to the insured person. More commonly though, fraudulent claims charge for services that were not provided or charge for a more expensive service than the one actually provided.

Detection of Fraud

The money paid out annually due to intentional and unintentional fraud runs into the billions. For this reason, authorities and insurance providers are working nonstop to detect and eliminate fraud. The biggest fraud-related crackdown in history was recorded in July 2017 when over 400 people were charged with fraudulent billing to Medicaid and Medicare.2

Improved auditing procedures are proving very successful in detecting fraud. Medicaid Fraud Control Units operate in 49 states. These units are excellent at detecting fraud. In 2016, MFCUs recovered more than $136 million in California alone. Individuals or practices engaging in fraud are at high risk of being detected.

Effects of Unintentional Fraud

The consequences of being caught engaging in fraud are severe. Courts take this type of fraud very seriously, and long jail sentences, such as the 22-year sentence given to a Florida dermatologist, are not uncommon. In addition, individuals and practices have been forced to make restitution to the tune of millions of dollars. Practices engaged in fraud also leave themselves exposed to fines and civil penalties.

It is important to understand that fraud, even when unintentional, is illegal and that any person, practice or organization found to be engaging in fraudulent activities risks prosecution. Furthermore, those individuals and practices caught engaging in fraud are at risk of being excluded from participating in any federal programs related to healthcare. Individuals are also at risk of losing their licenses to practice medicine.

The crippling penalties that may apply, or the obligation to make restitution for erroneous claims, can result in a practice going out of business. Even when a practice can survive the financial impact of having to make restitution for fraud, the publicity generated can cause a lack of trust among patients, resulting in a decline in patient numbers.

How to Protect Against Unintentional Fraud

Most incidents of unintentional fraud arise from paperwork mistakes or from ignorance of what is legal or illegal. Internal procedures, such as cross-checking forms or using external auditors such as a claims clearinghouse, can detect problems before claims are submitted.

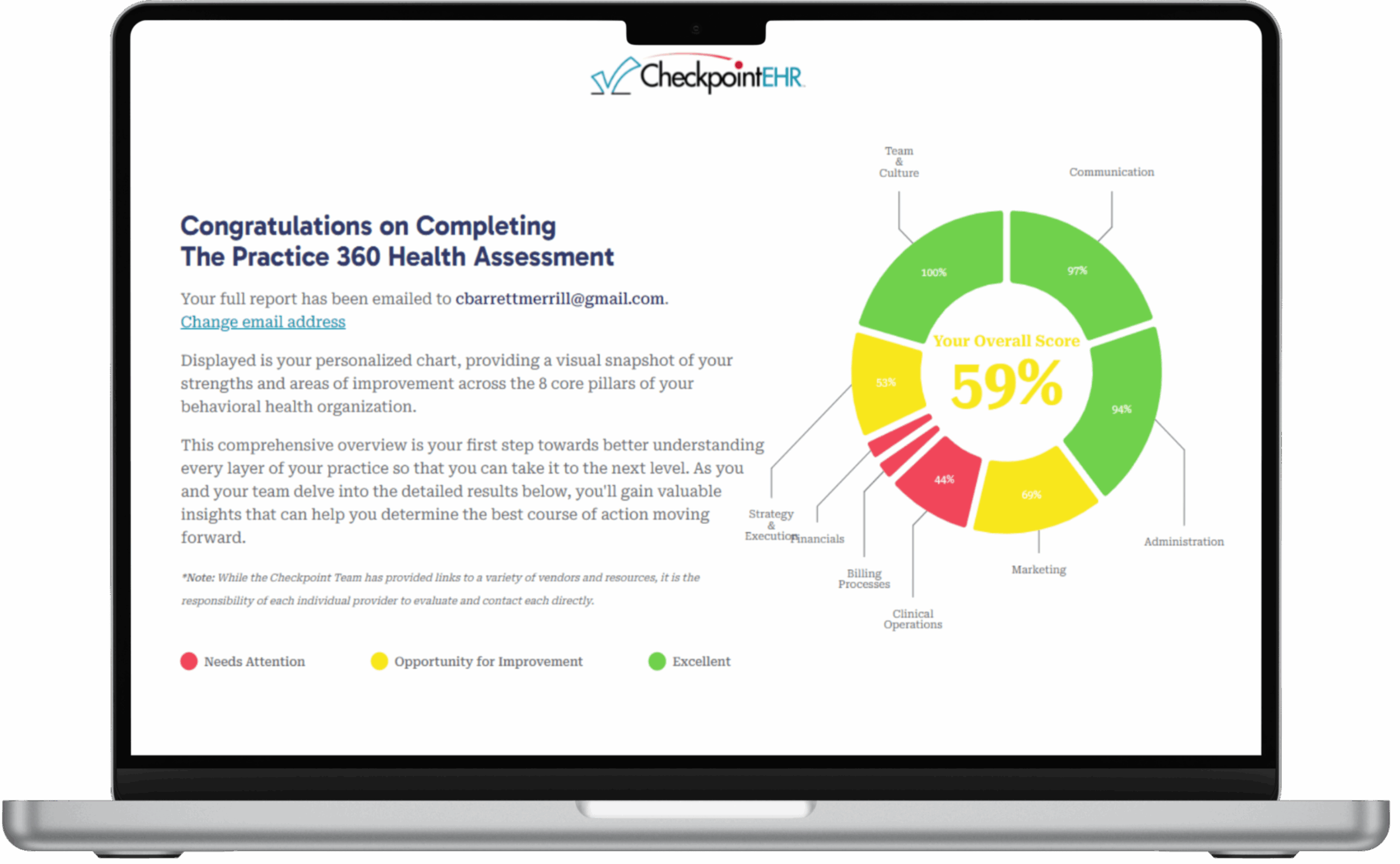

Practices that handle their medical coding in-house must ensure that the people responsible for coding are competent, fully trained and up to date. Coding errors can often be avoided by outsourcing the billing function, or using billing services provided by an EHR supplier. EHR providers such as Checkpoint EHR include claims management at no extra cost.