What is a Superbill for Therapy?

A Guide for Mental and Behavioral Health Therapists

As a behavioral health therapist, you may see clients who want to use their out-of-network insurance benefits. In these cases, the term superbill often comes up. But what exactly is a superbill and how does it work in a private practice setting? And what do you, as the provider, need to know to ensure clients can access these OON benefits?

Whether you’re new to private practice or refining your current systems, understanding how superbills work is important. Having a behavioral health superbill process can help you support your clients while keeping your documentation compliant and streamlined. Here are some of the basics that all mental health providers need to know.

What is a Superbill?

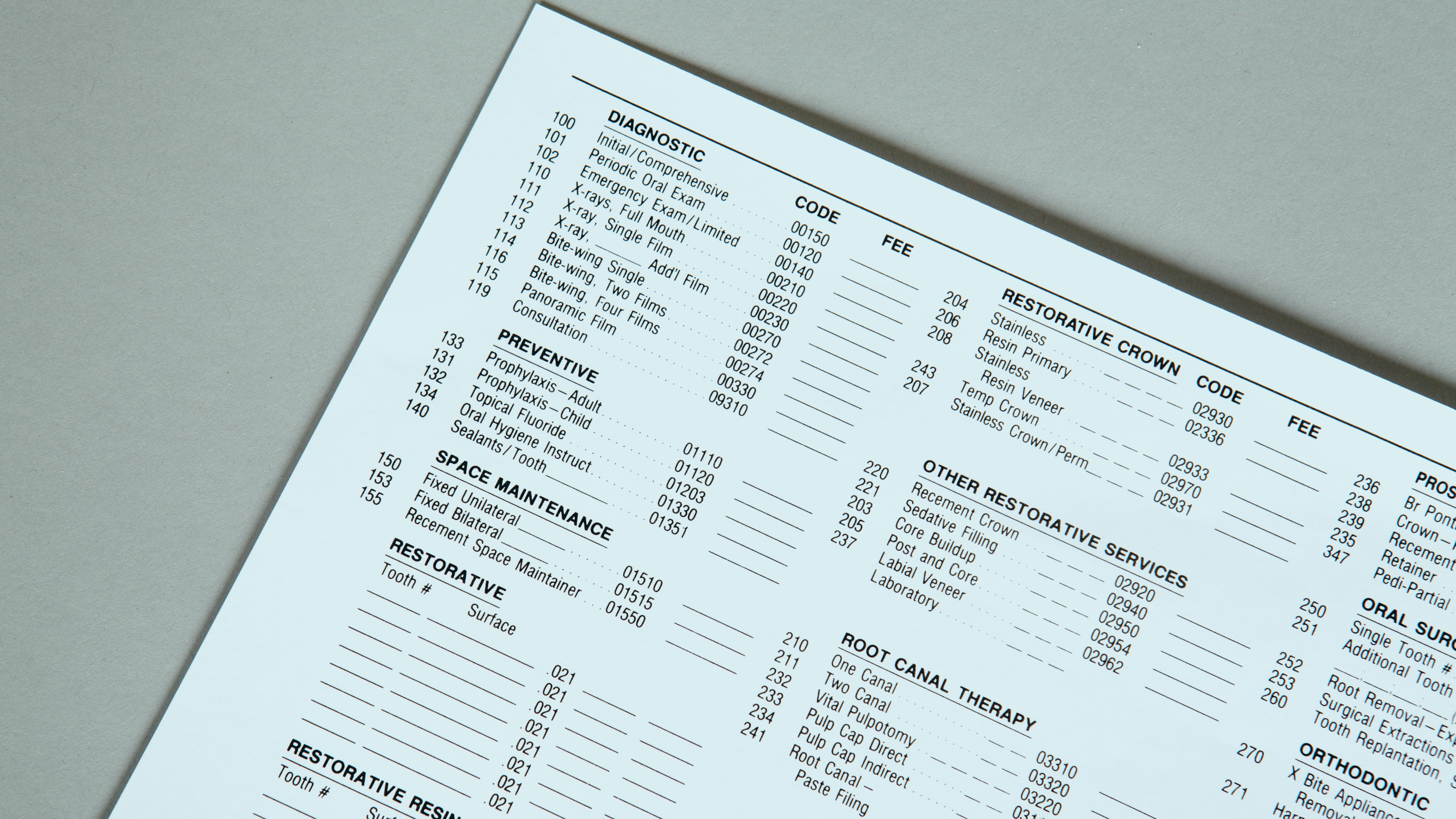

A superbill is an itemized receipt that a provider gives to a client after a session. These receipts include the necessary details for the client to seek reimbursement from their insurance company. Mental health superbills are not a bill in the traditional sense, but rather a detailed invoice. They include line items such as CPT codes, diagnoses, fees, and provider information.

Clients can submit the superbill to their insurance company if their plan includes out-of-network benefits. When do, clients can potentially receive partial reimbursement for the cost of the session.

How Superbill Reimbursement Works in Mental Health

In mental and behavioral health, superbills are especially common in private pay or out-of-network practices. Many therapists do not accept insurance directly. However, they may be out-of-network with some health insurance plans, and in these cases, a superbill helps clients use their benefits.

Here’s the typical workflow:

- The client pays the therapist the full session fee out of pocket.

- The therapist provides a superbill (usually monthly or after each session).

- The client submits the superbill to their insurance company.

- The insurance company evaluates the claim and reimburses the client based on their health plan’s out-of-network coverage.

It’s important to note that reimbursements are never guaranteed. Deductibles, diagnosis codes, plan exclusions, and paperwork errors can all impact the approval of a claim.

Who Creates the Superbill?

The therapist is responsible for generating the superbill. While it might sound administrative and time-consuming, there are some tools, like Thrizer, that offer streamlined superbill functionality.

Each superbill must include certain required elements, such as:

- Client name and date of birth

- Provider name, credentials, and NPI number

- Provider’s EIN or SSN (for tax purposes)

- Date of service

- CPT codes (e.g., 90837 for a 60-minute psycho-therapy session)

- ICD-10 diagnosis code(s)

- Fee charged per session

- Total amount paid

This guide from APA offers a helpful breakdown of what to include.

What Therapists Need to Do

If you plan to offer superbills, here’s what you need to have in place:

- Collect accurate client information: Especially date of birth, insurance details, and contact information.

- Assign accurate CPT and ICD-10 codes: Missteps here can lead to claim denials. Ensure that your documentation supports the codes you’re using.

- Maintain documentation: Keep clinical records that back up the services rendered and diagnoses provided.

- Provide timely superbills: Clients often appreciate receiving their superbills monthly or after every few sessions. Be clear about your process in your informed consent.

- Understand your legal responsibilities: Depending on your license and state, you might need to adhere to certain documentation standards.

If you’re unsure about billing codes or compliance, ZynnyMe’s billing resources offer great insight.

How Clients Submit Superbill Claims

Once the superbill is in their hands, the client can submit it to their insurance company via:

- Online insurance portals

- Mail or fax, depending on the plan

- Third-party apps, such as Thrizer or Reimbursify (some of which charge a small fee)

It’s important to educate clients that reimbursement depends on their specific plan, not the therapist’s documentation. Encourage clients to call their insurance provider ahead of time to ask:

- What is my deductible?

- What is my out-of-network coverage for mental health services?

- What percentage of session costs will they reimburse me?

- Are there any excluded diagnoses?

Pros and Cons of Superbills

Pros for Therapists:

- You are paid upfront, reducing the risk of denied insurance claims or slow payment.

- You retain more autonomy in your practice, free from panel restrictions or reimbursement rates.

- You avoid the administrative burden of credentialing and insurance billing.

Cons for Therapists:

- You need to stay on top of accurate documentation and CPT/ICD coding.

- Clients may become frustrated if payers deny their reimbursement, even with the correct superbill.

- Some clients may view private pay + reimbursement as too burdensome and seek in-network alternatives.

Pros for Clients:

- They can still access your services even if you’re not in-network.

- They may receive partial reimbursement, reducing their out-of-pocket burden.

Cons for Clients:

- Reimbursement is often slow or denied.

- Navigating insurance submissions can be confusing and time-consuming.

- They must pay the full session fee upfront, which isn’t financially feasible for everyone.

Additional Considerations

- Informed Consent: It’s helpful to include language about superbills and out-of-network reimbursement in your intake paperwork. Clients will benefit informed from the start.

- Diagnosis Disclosure: Some clients are surprised to learn that insurance companies require a diagnosis on the superbill. If a client doesn’t meet criteria for a diagnosable condition or doesn’t want a diagnosis submitted to insurance, they may choose not to pursue reimbursement.

- Limitations of Insurance: Even when a client receives partial reimbursement, it may not be substantial. For example, if your session fee is $150 and their plan reimburses 60% of the allowed amount ($100), they may only get $60 back. In this case, the client would still be paying $90 out of pocket to cover the remainder of the balance. Because this is such a common scenario, it’s important for providers to set realistic expectations.

Final Thoughts

Superbills are a practical bridge between fee-for-service private practice and insurance-based care. As a mental health therapist, providing superbills can help you reach clients who may not afford mental health therapy otherwise. In addition to increasing access to care, behavioral health superbills can increase financial sustainability for your practice.

While they do require some administrative effort, many EHR platforms simplify the process. Intuitive technology, along with clear communication with clients, can go a long way toward ensuring a smooth reimbursement experience. Whether you use superbills infrequently or often in your practice, it is important to understand how they work. Educating your clients is key.

Want to simplify your behavioral health billing process? Consider a mental health EHR system like CheckpointEHR that can streamline your entire billing system.